Whether you are a college student, saving up for a down payment on a house, or you simply like the flexibility of apartment living, it is a good idea to become familiar with renters insurance and how it can protect you.

Whether you are a college student, saving up for a down payment on a house, or you simply like the flexibility of apartment living, it is a good idea to become familiar with renters insurance and how it can protect you.

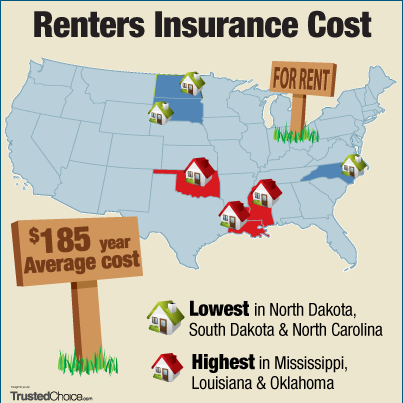

Renters insurance is known to be the least-utilized insurance coverage available despite the fact that it is also one of the most affordable, according to our partners at Trusted Choice. If you are on a tight budget, you may find it difficult to justify spending money on a policy that is not required. However, it is a good idea to investigate how much renters insurance costs to see how sensible and low cost this protection can be.

There are several steps involved in deciding how much renters insurance you need.

- Decide how much coverage you need for your personal property. To determine this, assess your belongings including furniture, electronics, clothing, artwork, kitchenware and collectables. Note that if you experience a loss, your reimbursement costs cannot exceed the coverage amount you choose, so be sure to think this through. In the event that you were to lose everything, would your coverage be enough to allow you get back on your feet and start over?

- Choose the amount of liability coverage you want. Your liability insurance will provide coverage for medical bills if someone is injured on your property, as well as legal expenses if needed. Because the cost of a law suit and legal fees can exceed $1 million, many insurance professionals recommend purchasing more than the standard coverage. If your liability coverage limit is $100,000, you could end up paying the costs of damages and legal fees out of pocket. Even raising the limit to $300,000 can provide peace of mind. While raising your liability limit will increase your premium, it’s probably more affordable than you think.

Most insurance companies impose caps on how much coverage they will provide for various categories of personal belongings. If you have an extensive amount of electronic equipment, designer clothing or any other sort of expensive collectable, you may want to consider purchasing additional endorsements, or riders, to obtain full coverage for these things. Get more information on Renter’s Insurance.

We Can Help You with Renters Insurance Today >>

Leave a Comment